Guys, are you a person who are difficult to manage and control the monthly expenses? You should not worry because you have not been late to change it. Yes! You can change it now by making a monthly budget template. It is a simple tool you can do to know where your money goes and where it should be stopped every month. As always, you are at a really good page because we are ready to share the simple tricks to make a budget template for a beginner. So, enjoy reading!

What is Budget Spreadsheet?

Well, before going further about Budget Spreadsheet Sample, we are better to know what Budget Template is. Like we have mentioned before, Budget Template is a template where you can input both the income and expenses in certain period of time, sometimes it is in a month. Through this template, you will be easy to track and control your monthly expenses accuracy. In the next following months, you can use the previous budget template record to decide which expenses should be stopped or even added.

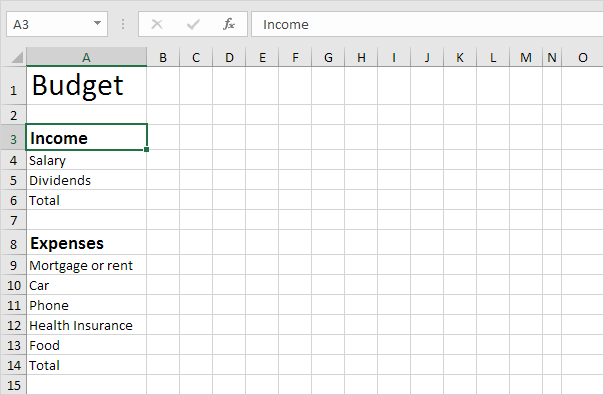

Monthly Budget Spreadsheet is a simple financial manager tool that can be use either electronic or printable or Google Sheets. When you use the electronic template, you can make Budget Spreadsheet on Microsoft Excel. Meanwhile, if you prefer to make it printable, you can design your own template using pen and pencil. Based on preference, either electronic or printable is the smart and easy way to manage your monthly income and expenses.

Steps to Make a Budget Spreadsheet

It is a great time to start making your budget template. Just be sure that you have been ready with the media. If you want to make it online, you can create the Google Sheets Account using your active email. Or, if you like to use the offline access, it is better to create the template on Microsoft Excel. And then, you can prepare a paper and pen if you want to make it printable. To make it attractive, you can use pencil colours, put the funny images or even add the impressive quotes. Alright, with no talk too much, here the simple step by step you can do:

-

Step 1# Write down the month or time

The first thing you do is about to write down the lists of time when you start organizing your monthly expenses through this budget template. If you use it every month, you can write it from January to December. Write the month detail at the top side differentiate it on the different columns.

-

Step 2# List the Income

The second thing you do is about to list the income you get in a month. It can be from monthly salary, rewards, freelance job, online marketing profit, bonus and many more. Everywhere you make the template; you can list the income section at the right side of the worksheet.

-

Step 3# List the Expenses

For the next, you need to make a list of expenses in a month. In this case, you can classify your expenses through some categories. For example, it is for the household and rent, food and beverage, health, entertainment, transportation and so on. You don’t need to fill all columns but just list all things where you probably spend your money.

-

Step 4# List the Investment and Saving

Then, it may be good to make a list of investment at the next part of your budget template. It may be difficult for you who have a few amount of income but it may be worth. Yes, you can start write it down and probably it can motivate you to work harder. If it is possible, you can spend 2-5% of your income to investment or saving.

-

Step 5# Summarize both income and expenses

For the rest, you have listed both income and expenses you may get in a month. Then, you can summarize your total income as well as the total expenses. Once you get the total income and expenses amount, you can get the remaining fund’s amount as well or maybe the lack of funds. If you get the second result, you should revise your expenses in a month and ensure to limit it in the next month.

What are the Benefits of Making a Monthly Budget Spreadsheet?

Have you tried to make your own budget template? Then, what’s it feel? For your information, there are some benefits of making this type of template and here they are:

- First of all, you will be more care with your income and expenses. If you know the result of the last fund and where it was been spent, you may know what things to do next to make it better.

- Then, you can control your expenses. Especially, you can limit the expenses for something you should not buy.

- If you think that you need the more income to fill the expenses, you will be more motivated to work harder or even try the other chances to increase it.

- You will be more discipline and wise in managing the income.

- It helps you to keep a few incomes for savings or investment that will be useful for you in the next day.

And, it is all about Budget Templates. We hope it can motivate you to be more detail and care with your financial cycle. Sure, it is better to spend less than its earn. Thanks for reading this article, we hope that you visit our YouTube Channel to know the simple practices to write a simple monthly budget template for beginners. See you soon!