Here are some frequently asked questions (FAQs) regarding bank reference letter:

Q: What is a bank reference letter?

A: A bank reference letter is a document provided by a bank or financial institution that provides information about a customer’s financial history and creditworthiness.

Q: When is a bank reference letter required?

A: A bank reference letter may be required when a customer is applying for a loan or credit, renting a property, or applying for a job that requires a background check.

Q: Who should write a bank reference letter?

A: The bank or financial institution where the customer has an account should provide the bank reference letter.

Q: What information should be included in a bank reference letter?

A: A bank reference letter should include the name and address of the bank or financial institution, the name of the customer, the type of account, the account number, the account balance, and the length of the customer’s relationship with the bank. It may also include information about the customer’s creditworthiness and financial history.

Q: Is a bank reference letter necessary?

A: A bank reference letter may be necessary in certain situations where information about a customer’s financial history and creditworthiness is required.

How to write a bank reference letter:

1. Use official letterhead or stationary for the bank or financial institution.

2. Include the date of the letter, the name and address of the bank or financial institution, and the name of the customer.

3. Provide details about the customer’s account, including the type of account, the account number, and the account balance.

4. Describe the length of the customer’s relationship with the bank or financial institution.

5. Include any relevant information about the customer’s creditworthiness and financial history.

6. Provide contact information for the bank or financial institution, including a phone number and email address for further inquiries.

7. Sign the letter and include the official stamp or seal of the bank or financial institution.

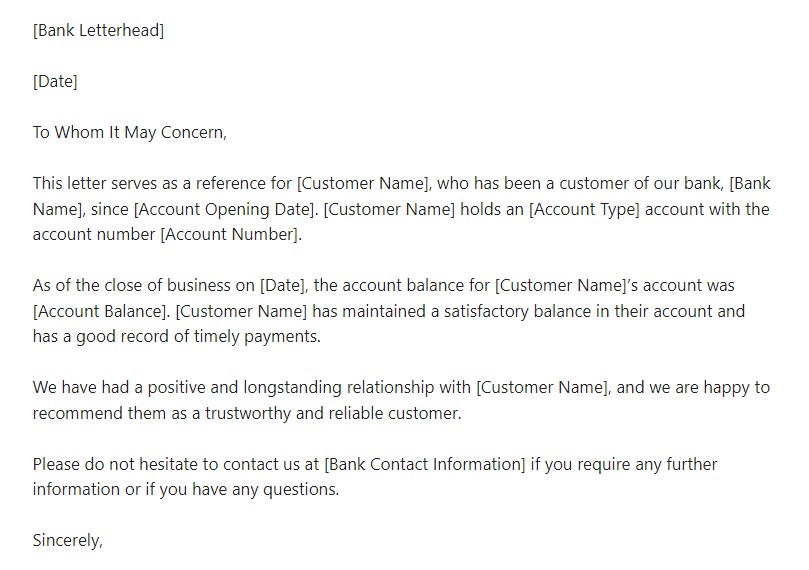

Sample of a bank reference letter:

[Bank Letterhead]

[Date]

To Whom It May Concern,

This letter serves as a reference for [Customer Name], who has been a customer of our bank, [Bank Name], since [Account Opening Date]. [Customer Name] holds an [Account Type] account with the account number [Account Number].

As of the close of business on [Date], the account balance for [Customer Name]’s account was [Account Balance]. [Customer Name] has maintained a satisfactory balance in their account and has a good record of timely payments.

We have had a positive and longstanding relationship with [Customer Name], and we are happy to recommend them as a trustworthy and reliable customer.

Please do not hesitate to contact us at [Bank Contact Information] if you require any further information or if you have any questions.

Sincerely,

[Bank Officer Name]

[Bank Officer Title]

[Bank Name]