As the gig economy continues to thrive, an increasing number of individuals are opting for freelance work and independent contracting opportunities. While the flexibility and freedom associated with being an independent contractor are appealing, it’s crucial to understand the financial aspects that come with it. One essential document for independent contractors is the 1099 pay stub. In this article, we will explore what a 1099 pay stub is and why it’s important for contractors.

What is a 1099 Pay Stub?

Unlike traditional employees who receive a W-2 form, independent contractors receive a 1099-MISC form that details their income for tax purposes. Along with the 1099-MISC, independent contractors might receive a 1099 pay stub, which serves as a summary of their earnings and deductions during a specific period.

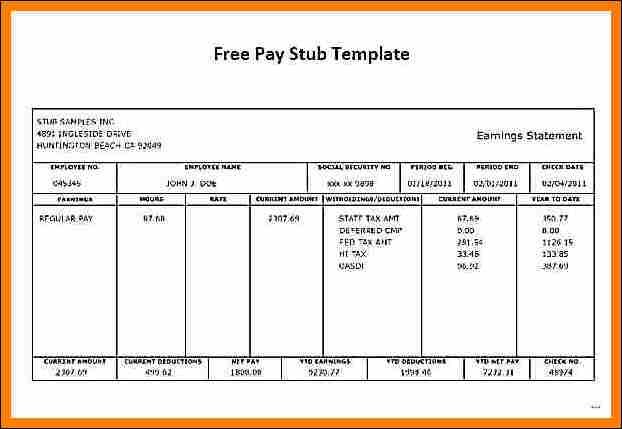

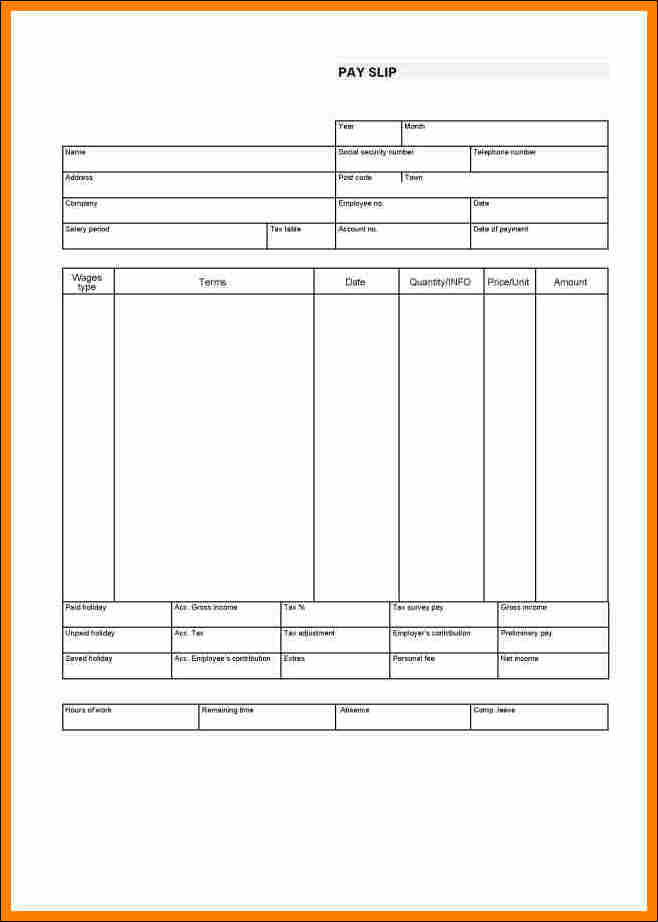

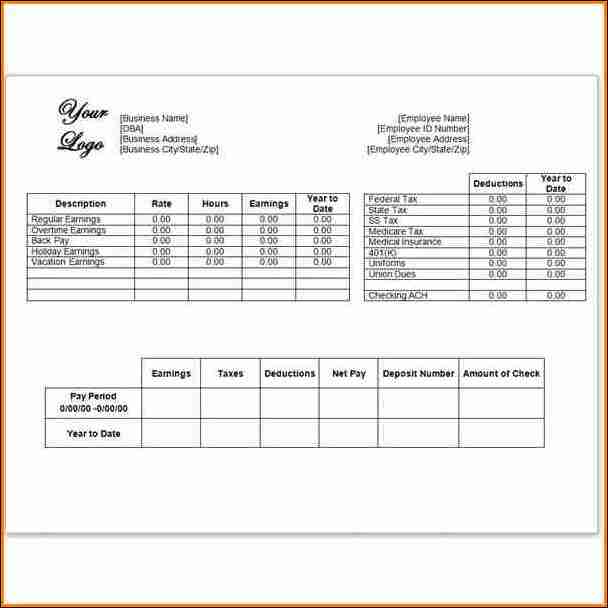

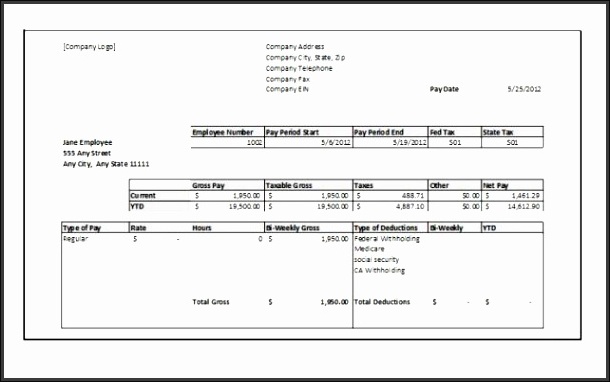

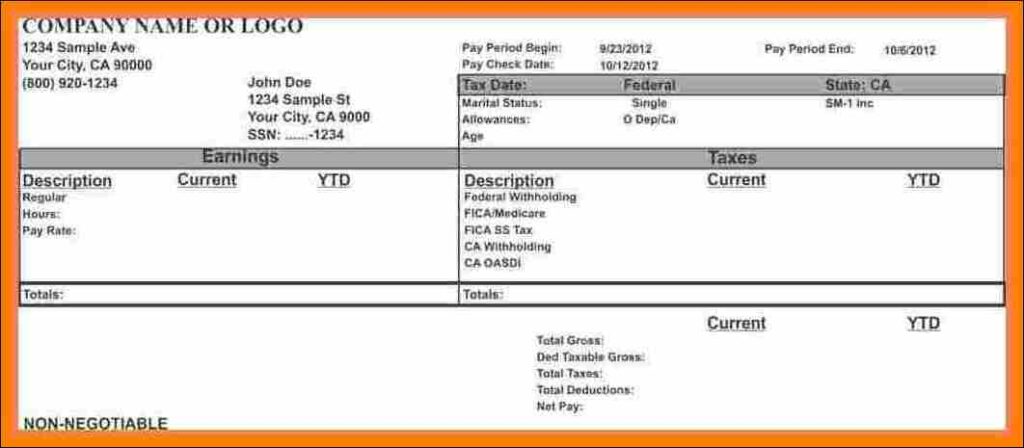

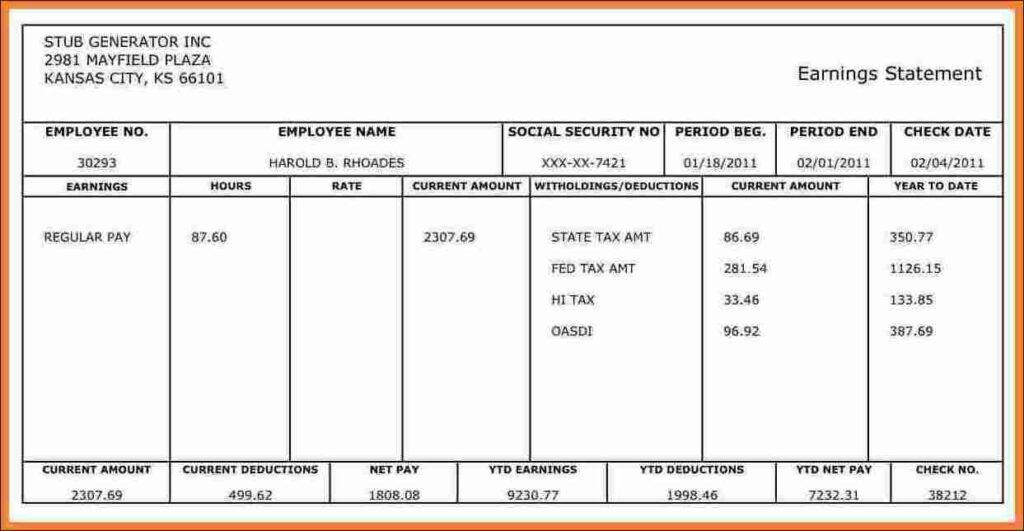

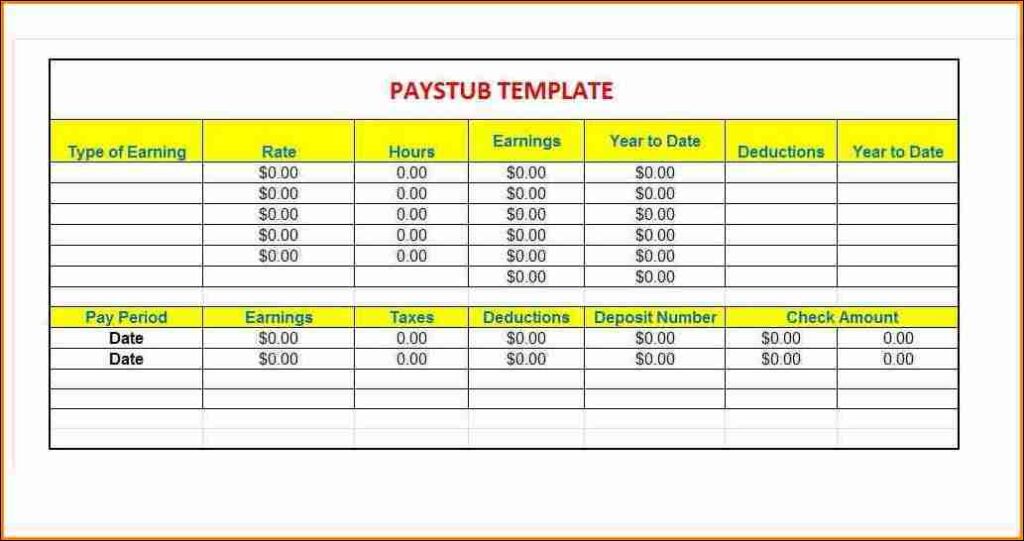

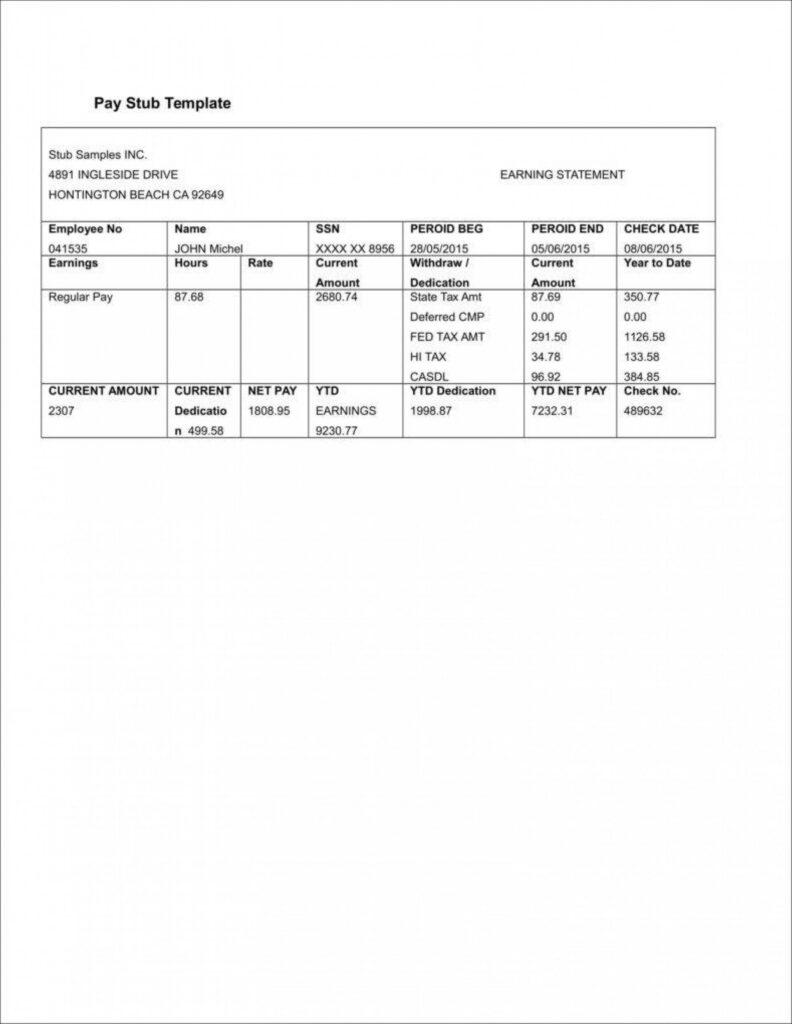

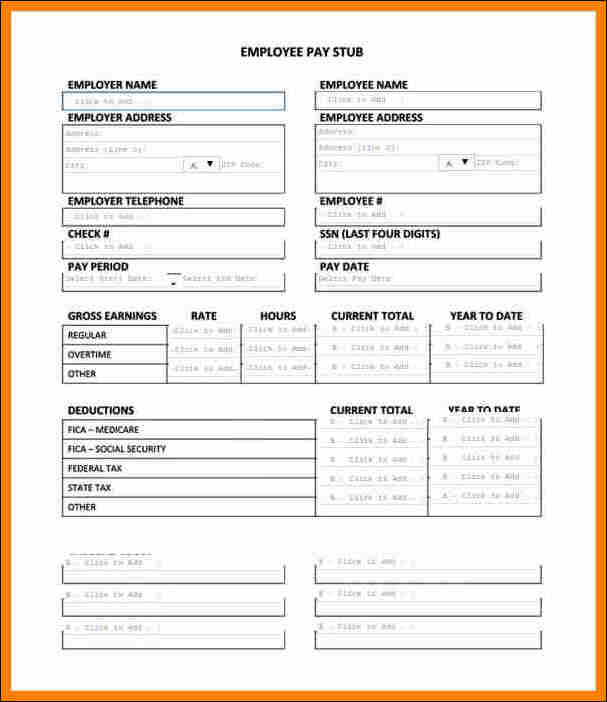

Key Information on a 1099 Pay Stub:

- Contractor and Employer Information: The pay stub typically includes the name, address, and contact details of the independent contractor, as well as the employer or client’s information.

- Earnings and Payments: The pay stub provides a breakdown of the contractor’s earnings for the given period. It includes details such as the amount earned, the pay rate, the number of hours worked (if applicable), and any additional payments or bonuses.

- Deductions and Withholdings: Independent contractors are responsible for paying their own taxes and are not subject to payroll tax withholdings. However, they may have other deductions, such as expenses related to their work. The pay stub may outline these deductions, providing a clear picture of the contractor’s net income.

- Dates and Period Covered: The pay stub will include the dates or period for which the earnings are reported. This allows contractors to track their income for a specific timeframe, making it easier to manage their finances and plan for tax obligations.

Why is the 1099 Pay Stub Important?

- Tax Compliance: The pay stub provides crucial information necessary for accurate tax reporting and compliance. Contractors can use it to calculate their self-employment taxes and ensure they meet their tax obligations.

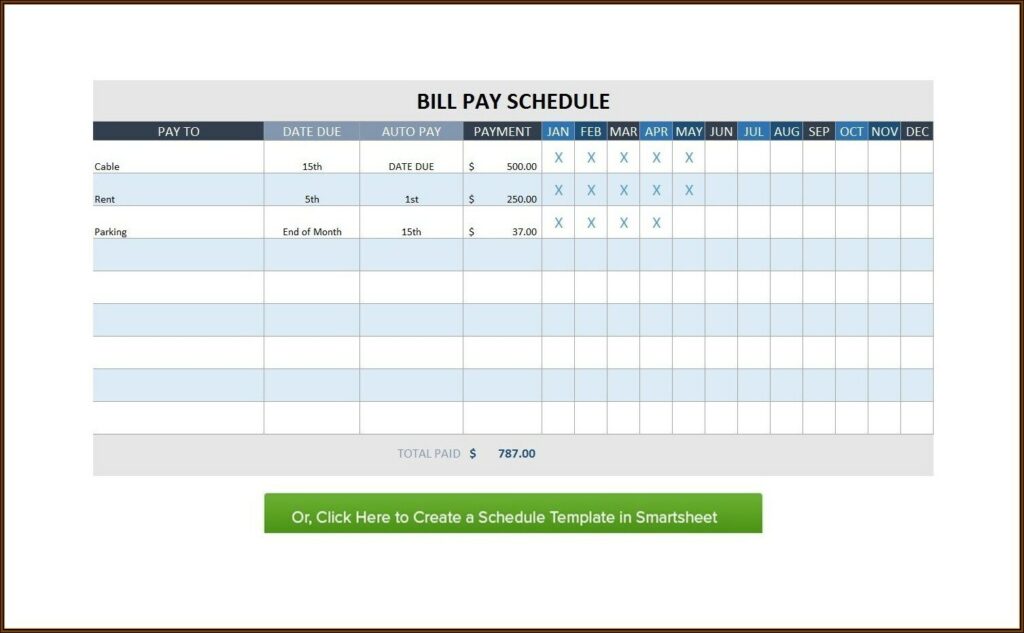

- Financial Management: By reviewing their pay stubs regularly, contractors can track their earnings and monitor their financial progress. It allows them to budget effectively and make informed decisions about their income and expenses.

- Proof of Income: A 1099 pay stub serves as proof of income for independent contractors. It can be used for various purposes, such as applying for loans, mortgages, or renting an apartment.

For independent contractors, understanding the 1099 pay stub is essential for maintaining financial transparency and meeting tax obligations. This document provides a comprehensive overview of earnings, deductions, and other pertinent details, allowing contractors to manage their finances effectively. By keeping track of their pay stubs, contractors can ensure accurate tax reporting, monitor their income, and demonstrate proof of earnings when needed.

FAQ bout 1099 pay stub

Q: What is a 1099 pay stub?

A: A 1099 pay stub is a document that provides a summary of an independent contractor’s earnings and deductions during a specific period. It accompanies the 1099-MISC form and serves as a record of income for tax purposes.

Q: Do all independent contractors receive a 1099 pay stub?

A: Not all independent contractors receive a 1099 pay stub. The issuance of a pay stub is dependent on the employer or client. Some may provide pay stubs to contractors for transparency and record-keeping purposes, while others may not.

Q: What information is typically included on a 1099 pay stub?

A: A 1099 pay stub usually contains the contractor’s and employer’s information, including names, addresses, and contact details. It also includes details such as earnings, pay rates, hours worked (if applicable), any additional payments or bonuses, and deductions related to the contractor’s work.

Q: Are taxes withheld from a 1099 pay stub?

A: No, taxes are not typically withheld from a 1099 pay stub. Unlike traditional employees who receive a W-2 form with tax withholdings, independent contractors are responsible for paying their own taxes. However, they may have deductions related to business expenses.

Q: Can a 1099 pay stub be used as proof of income?

A: Yes, a 1099 pay stub can be used as proof of income for independent contractors. It can be presented when applying for loans, mortgages, renting an apartment, or other situations where proof of earnings is required.

Q: How can I obtain a 1099 pay stub?

A: The responsibility of providing a 1099 pay stub lies with the employer or client. If you are an independent contractor and haven’t received a pay stub, you can reach out to the employer or client and request one. Alternatively, you can maintain your own record of income and expenses using accounting software or spreadsheets.

Q: Can I use my 1099 pay stub to file taxes?

A: While a 1099 pay stub provides valuable information for tax reporting, it is not used directly to file taxes. Independent contractors should use their 1099-MISC form, which includes the total income earned during the tax year, to report their earnings on their tax return. The pay stub can serve as a reference to calculate deductions and provide additional details when filing taxes.

Q: Are there any differences between a 1099 pay stub and a W-2 pay stub?

A: Yes, there are notable differences between a 1099 pay stub and a W-2 pay stub. A 1099 pay stub is provided to independent contractors, while a W-2 pay stub is given to employees. Independent contractors are responsible for their own taxes, while taxes are typically withheld from employees’ paychecks. Additionally, the information and format of the pay stubs may vary.

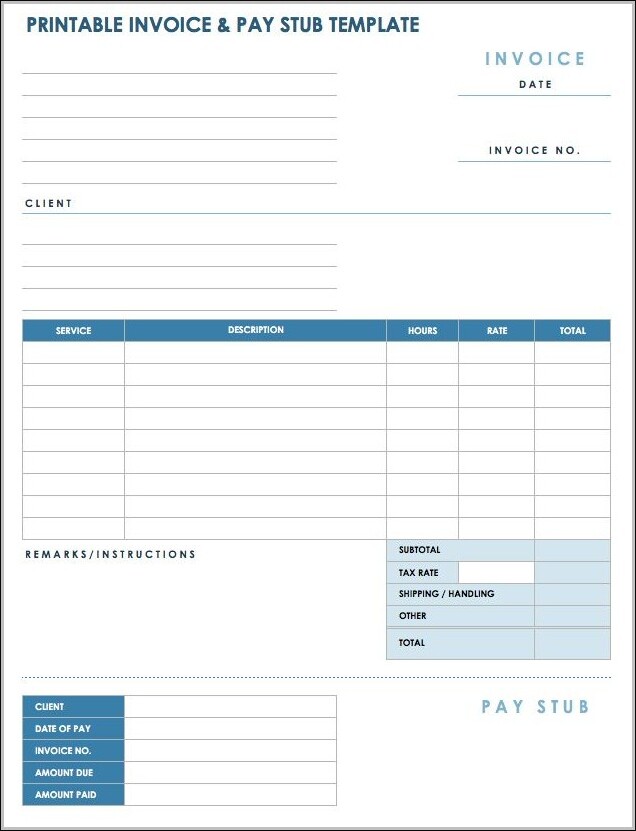

Sample 1099 pay stub template

[Your Name]

[Your Address]

[City, State, ZIP]

[Email Address]

[Phone Number]

[Client/Employer’s Name]

[Client/Employer’s Address]

[City, State, ZIP]

[Date]

Pay Stub for [Month/Period Covered]

Contractor Information:

Name: [Your Name]

Address: [Your Address]

City, State, ZIP: [City, State, ZIP]

Email: [Your Email Address]

Phone: [Your Phone Number]

Earnings:

| Description | Amount |

| Base Income | $[Amount] |

| Additional Income | $[Amount] |

| Total Earnings | $[Total Earnings] |

Deductions:

| Description | Amount |

| Business Expenses | $[Amount] |

| Taxes | $[Amount] |

| Total Deductions | $[Total Deductions] |

Net Income: $[Net Income]

Payment Details:

| Description | Amount |

| Payment Method | [Payment Method] |

| Payment Date | [Payment Date] |

Please note that this pay stub is provided for informational purposes only and does not serve as a legal or official document. It is your responsibility to retain accurate financial records and consult with a tax professional for proper tax reporting.

If you have any questions or concerns regarding this pay stub, please contact us at [Client/Employer’s Contact Information].

Thank you.

[Your Name]

[Your Signature]

[Client/Employer’s Name]

[Client/Employer’s Signature]