Are you ready to donate a car in Maryland? If so, that’s great for you! To donate a car in Maryland is an extraordinary decision on many levels. First thing first, your donation is used to help a big cause. Besides, you get your old vehicle or junk car moved from your property for free. More to get, you can also recycle old vehicles, and claim car donations as tax deductions.

How to Donate A Car in Maryland?

Well, just in case it is your first time, you need to find the full guide on how to donate a car in Maryland. Don’t worry! Here we have the full guides for you so that you know what to do after reading the following tips. Check them out!

Donate A Car in Maryland

To donate a car in Maryland, you start by submitting a car donation form online or contacting the charity you want to donate a vehicle to. If you want to claim a car donation as a tax deduction, first of all, you have to ensure to check that the charity is a non-profit organization recognized by the IRS.

The Processes of Receiving Taxes are Various

The process of receiving tax receipts for your charitable donations may be different. Some charities will send you an early receipt. Meanwhile, others have a tow truck that gives you a receipt when picked up. This is just an initial receipt. It allows you to claim a tax deduction of up to $500.

When you send your vehicle donation, you should check with the charity to find out their procedure for providing this receipt.

Know the Rule

To donate a car in Maryland, the license plate remains on the vehicle. Therefore, it must not be removed before collection.

Submit the Disclaimer

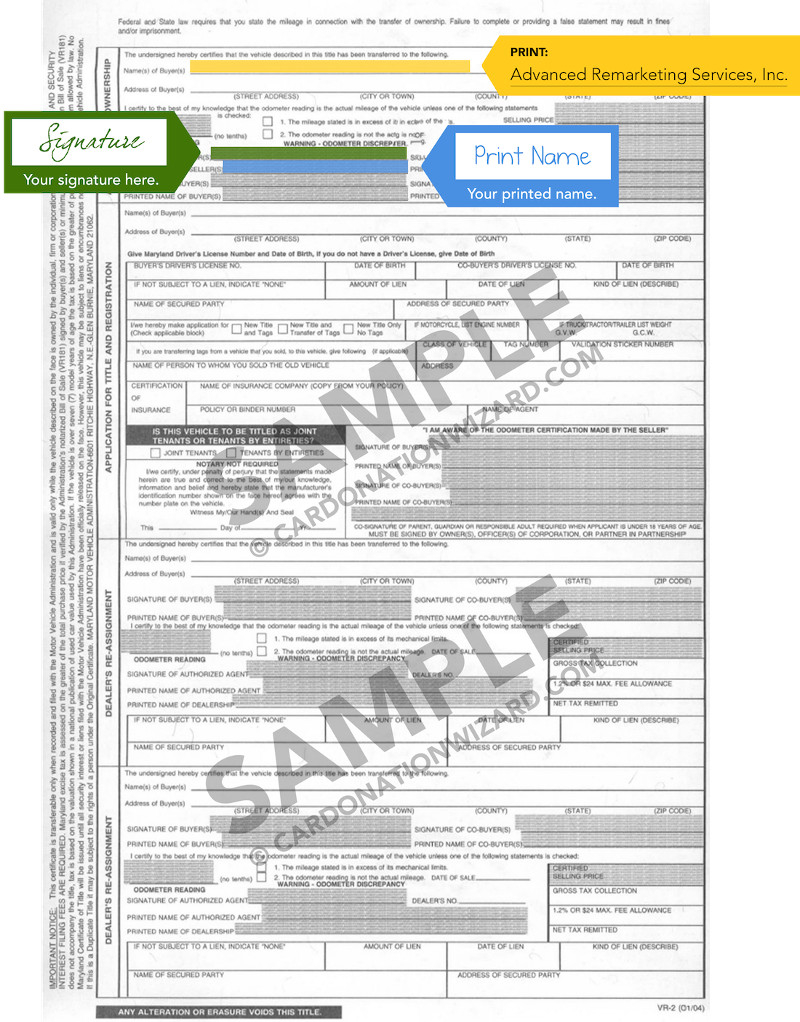

Yes, you need to submit a Maryland Donation Disclaimer. Before you donate, you have to prepare the file of Disclaimer with the Maryland Department of Motor Vehicles. It is an important step you don’t want to miss when you donate a car.

This document relieves you of any future liability. And it may arise for any reason after the vehicle is donated. In Maryland, the procedure for applying for a Liability Release is that you must return the pink portion of the title or REG 138 DMV form. You can submit it to your local Department of Motor Vehicles.

Ensure You Are Eligible

Besides, it is important to be sure that you are eligible for the Fair Market Value Tax Deduction from Car Donations. You need to pay attention when your vehicle sells for more than $500. If it qualifies for a fair market value tax deduction, you will receive additional tax documents once the vehicle sale is made.

The amount you can deduct from your taxes will vary depending on several factors. They may include the price of the vehicle being sold. Or maybe, it is about the vehicle which is classified as a fair value market car donation.

Do You Know? Donate a Car in Maryland Can Help Veterans

By donating a car in Maryland, you can help veterans when they come home. You can find some programs and services that veterans in America can benefit from. Helping everyone is a challenge. However, this one is another level of donating.

Donate a Vehicle and Help A Veteran In Need at Once

Here, you can schedule to donate a car in Maryland. There are three easy steps you can follow to do so. And you can see, how easy your vehicle donation to vehicles for veterans really is!

Contact the Staff

You can call 1-855-811-4838 to speak with a member of our staff for immediate scheduling of your vehicle donation. It is a hotline of representatives if you want to donate a car in Maryland for veterans. Here, they will answer any questions you may have related to the program.

Fill Out the Form

Alternatively, you can also try to fill out the online donation form. For the next, you will be contacted by a member of our staff. You just need to wait within 24 hours of the next business day.

Save Your Withholding Tax Receipt

Save your withholding tax receipt for next year’s taxes. Any donations received before 11:59 PM on December 31 are counted for that tax year.

To donate a car in Maryland for veterans may not seem like much to you. However, they can really make a difference in a veteran’s life. Your vehicle donation can be very helpful to provide needed services to veterans. So that, you can consider this one.