If you’re an accountant, having a well-crafted resume is essential for landing your dream job. Here are some top tips to help you write an accountant resume that stands out from the competition and gets noticed by hiring managers.

Here are some frequently asked questions about accountant resume:

Q: What should be included in an accountant resume?

A: An accountant resume should include your contact information, professional summary or objective, relevant skills, education and certifications, work experience, and any notable achievements or awards.

Q: What are some relevant skills to include on an accountant resume?

A: Relevant skills to include on an accountant resume may include proficiency in accounting software, financial analysis, budgeting and forecasting, tax planning and compliance, audit and risk assessment, and communication and collaboration.

Q: How should work experience be presented on an accountant resume?

A: Work experience should be presented in reverse chronological order, starting with your most recent position. Each entry should include the name of the company, your job title, dates of employment, and a list of your responsibilities and accomplishments in that role.

Q: Should I include references on my accountant resume?

A: No, it is not necessary to include references on your accountant resume. Instead, you can indicate that references are available upon request.

Q: How long should an accountant resume be?

A: An accountant resume should generally be one to two pages in length, depending on the extent of your work experience and qualifications.

Q: Should I include a cover letter with my accountant resume?

A: It is recommended to include a tailored cover letter with your accountant resume, as it provides an opportunity to highlight your skills and qualifications in greater detail and explain why you are interested in the position.

Q: What are some common mistakes to avoid when writing an accountant resume?

A: Common mistakes to avoid when writing an accountant resume include spelling and grammatical errors, using vague or generic language, including irrelevant information, and failing to tailor the resume to the specific job and company you are applying to.

Here are some steps to help you write an effective accountant resume:

1. Begin with a header that includes your name, contact information, and professional title.

2. Write a professional summary or objective that summarizes your experience, skills, and qualifications. Be sure to customize this section to the specific job you are applying for.

3. List your relevant skills and certifications. Focus on skills that are specific to the accounting profession, such as proficiency in accounting software, financial analysis, and tax planning.

4. Include your education and any relevant certifications or licenses. Be sure to include the name of the institution, your degree or certification, and the date of graduation.

5. Provide details about your work experience. List your previous accounting jobs in reverse chronological order, starting with your most recent position. For each job, include the name of the company, your job title, dates of employment, and a list of your responsibilities and accomplishments.

6. Highlight any notable achievements or awards that demonstrate your success as an accountant. For example, if you reduced costs or increased revenue for a previous employer, include that information in your resume.

7. Tailor your resume to the specific job and company you are applying for. Use keywords and phrases from the job posting to ensure your resume aligns with the employer’s requirements.

8. Proofread your resume for spelling and grammatical errors. Ask a friend or colleague to review it as well.

9. Consider including a cover letter that highlights your qualifications and interest in the position.

Remember, an effective accountant resume should be clear, concise, and tailored to the specific job you are applying for. Focus on your relevant experience and skills, and demonstrate your value as an accounting professional.

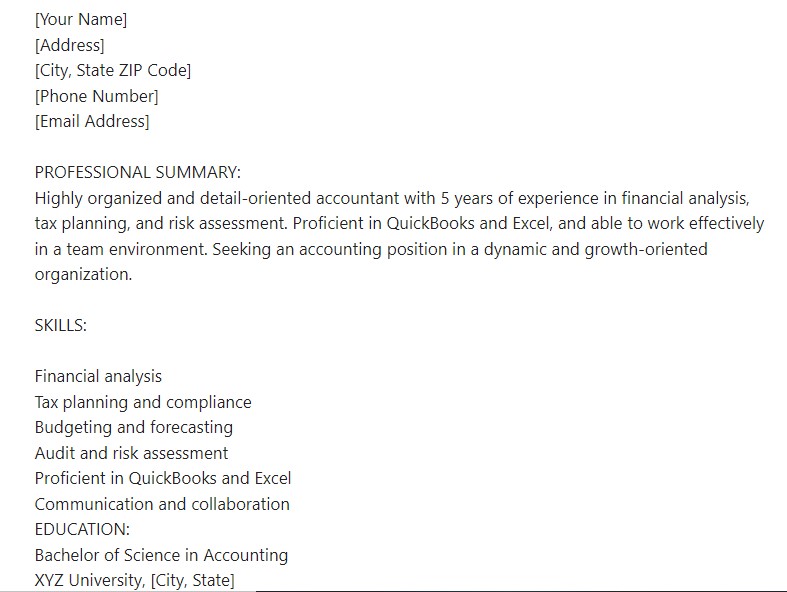

Here is a sample accountant resume that you can use as a guide when creating your own:

[Your Name]

[Address]

[City, State ZIP Code]

[Phone Number]

[Email Address]

PROFESSIONAL SUMMARY:

Highly organized and detail-oriented accountant with 5 years of experience in financial analysis, tax planning, and risk assessment. Proficient in QuickBooks and Excel, and able to work effectively in a team environment. Seeking an accounting position in a dynamic and growth-oriented organization.

SKILLS:

Financial analysis

Tax planning and compliance

Budgeting and forecasting

Audit and risk assessment

Proficient in QuickBooks and Excel

Communication and collaboration

EDUCATION:

Bachelor of Science in Accounting

XYZ University, [City, State]

Graduated: May 20XX

CERTIFICATIONS:

Certified Public Accountant (CPA)

Issued by the American Institute of Certified Public Accountants

License number: [Insert license number]

WORK EXPERIENCE:

Senior Accountant

ABC Company, [City, State]

June 20XX – Present

Manage the company’s financial reporting and analysis, including monthly and quarterly financial statements and variance analysis

Perform tax planning and compliance duties, including preparation and review of federal and state tax returns and coordination with external auditors

Develop and maintain internal control procedures and ensure compliance with accounting policies and procedures

Collaborate with cross-functional teams to support business operations and provide financial guidance and analysis

Implement process improvements to increase efficiency and accuracy in financial reporting and analysis

Accountant

XYZ Firm, [City, State]

June 20XX – June 20XX

Assisted with the preparation of financial statements, including balance sheets, income statements, and cash flow statements

Conducted financial analysis and provided recommendations for cost savings and revenue growth opportunities

Prepared and reviewed federal and state tax returns for individuals and small businesses

Managed accounts receivable and accounts payable functions, including billing and collections and vendor payments

Assisted with the development and implementation of accounting policies and procedures

ACHIEVEMENTS:

Recognized as “Employee of the Month” for outstanding performance in financial analysis and reporting

Successfully reduced costs by 15% through implementation of new accounting software and processes

REFERENCES:

Available upon request.

Remember to tailor your resume to the specific job you are applying for, and use this sample as a guide to create a professional and effective accountant resume.