What is Billing Statement?

A billing statement is a month to month report that MasterCard organizations issue to MasterCard holders indicating their ongoing exchanges. It can be month to month least instalment due, and other indispensable data. These charging proclamations are given month to month toward the finish of each charging cycle.

How a Billing Statement Works

Billing Statements are a basic bit of correspondence, furnishing a borrower with the base regularly scheduled installment. It means that they should pay to keep their record current. It incorporates other significant data, for example and the exchanges that happened during the month. Besides, it also exchange the all out intrigue charged for the month complete with any expenses added to the equalization by the credit backer. In the same case, it shows the end explanation balance that is payable off altogether by the borrower.

Usually, a billing statement has several sections. One section contains the cardholder’s previous balance, payments, and credits as well. They will show how much money they’ve paid toward their balance plus any merchant refunds. Besides, you can also check the total dollar amount of new purchases made during the billing cycle that just ended. Yes, you can check the latest balance transfers, cash advances, fees charged, complete with interest charged, and the new total balance as well.

How to Get Your Billing Statement?

Simply, you can go to the bank and start approaching the employee to create a billing statement for you. Anyway, it is also possible that you request for an automatic request of monthly billing statement so that you will receive it every month without having to request it for many times.

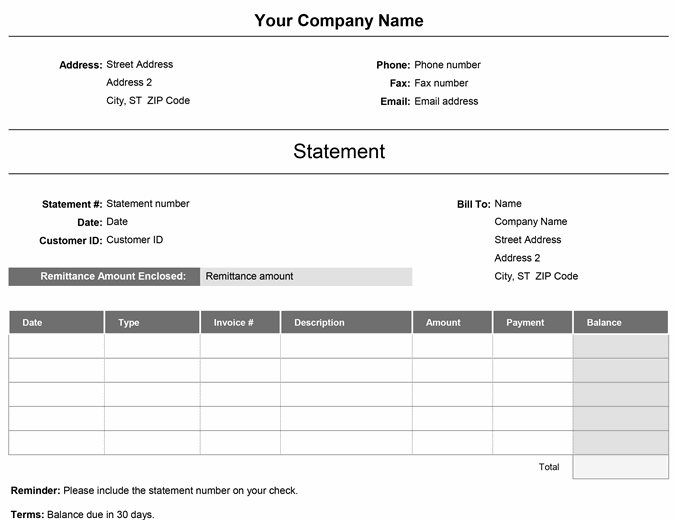

How to Write a Billing Statement?

To compose a billing statement, first recognize your business by its name, address and contact data. Show the client, receipt number and the date, portrayal and measure of everything. Remember to include instalment terms and conditions at the base of the receipt. For example, let the client think about a punishment of the receipt isn’t paid by a cutoff time.

- Step 1:

Select Customers and Create Statements

- Step 2:

Indicate the date that will show up on the announcement

- Step 3:

Choose dates in the Statement Period from fields, or pick All Open Transactions as of Statement Date to make an announcement for every single exceptional receipt

- Step 4:

If you decide to get ready explanations for every extraordinary receipt, check this case to constrain the announcements to solicitations in excess of an assigned number of days late

- Step 5:

Select the clients who will get explanations. On the off chance that you select any choice other than All Customers, you would then be able to choose the particular clients who will get proclamations.

- Step 6:

Fill Account Transactions. A critical segment of a MasterCard billing statement is used for the exposure of exchanges. Commonly a credit guarantor will give an ordered outline of financing costs charged by the exchange classification toward the start of the exchange report. The record exchanges area will at that point show every exchange charged during the billing cycle. Exchanges ordinarily incorporate point by point data about the charge including the exchange date, post date, shipper name, and exchange sum.

- Step 7:

The Bottom Line. For the most part, billing statements will likewise incorporate an instalment coupon for shoppers who send their instalments via mail and data about various approaches to contact the MasterCard guarantor with any inquiries.

Alright, it is all about Billing Statement. We hope it will be useful for any purposes you have. Anyway, thanks for reading and watching our video. Please leave the comments below and help us improving. Have a good day!