Guide on How to Sell Annuity Payment in 5 Steps

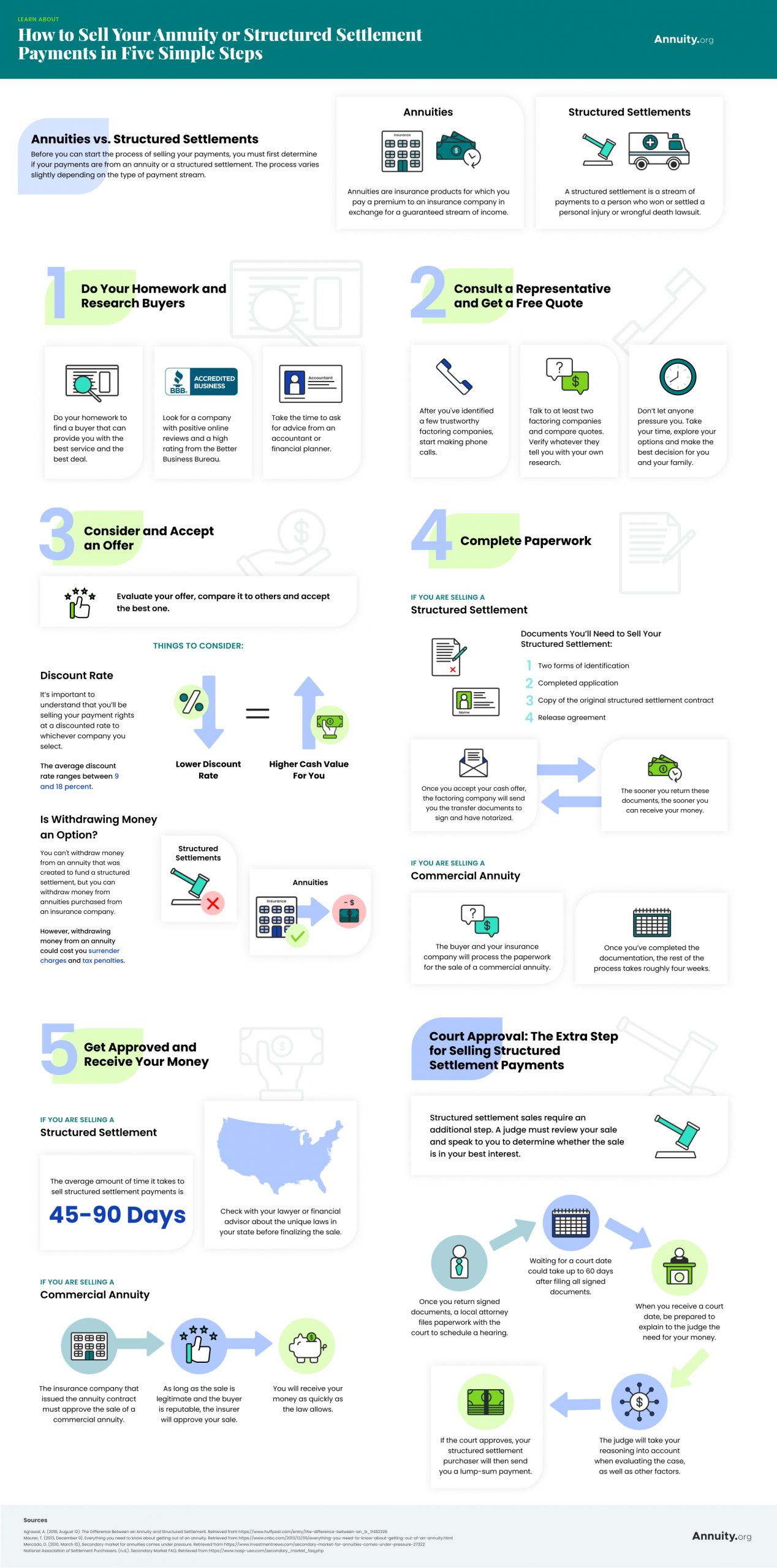

Do you want to sell annuity payment and structured settlement payments? First thing first, you need to take an honest check out your situation. Choose if you actually need your money directly. If the solution is yes, ensure you’re informed, prepared, and on top of things.

There are several key differences between the methods to sell annuity payment. Therefore the process of selling a structured settlement payment. To know this difference, you want to first understand that an annuity and a structured settlement aren’t an equivalent thing.

What is Sell Annuity Payment?

Annuities are insurance products which will be purchased from insurance companies or agents. People pip out as a part of a long-term pension plan to ensure income in their retirement years.

A structured settlement, on the opposite hand, may be a periodic payment that’s negotiated between the plaintiff and therefore the defendant in cases of private injury and death to compensate the plaintiff’s losses. They are most frequently handled by licensed structured settlement brokers using annuities, or other eligible funding assets to finance payments.

Their status makes sell annuity payment a structured settlement annuity a bit more complicated. Well, if you compare to sell annuity payment. But, most of the method is that the same.

Here are 5 Steps to Sell Annuity Payment

STEP #1: Do Your Homework and Buyer Research

A simple internet search may be a great way to start out researching purchasing companies. Do your homework to seek out a buyer who can provide you with the simplest service. Therefore you can get the best deal. Search for companies with positive online reviews and high ratings from the higher Business Bureau. Also, take the time to hunt advice from an accountant or financial planner. Do everything you’ll to seek out reputable buyers available to answer your questions.

STEP #2: Consult a Representative and obtain a Free Quote

Once you’ve identified some trustworthy structured settlement buyers. Start making phone calls. Ask a customer service representative who will explain sell annuity payment options. Find the one with an easy-to-understand way without confusing jargon. You can ask each company for a free quote.

It’s okay to let potential payment buyers know that you’re getting offers from several companies. You’ll get a far better deal if the corporate knows you’re searching for the simplest deal. Talk to in any case two structured settlement buyers and compare offers. Verify anything they tell you together with your own research.

You can also contact us to seek out what proportion your structured settlement or annuity is worth. We will recommend reputable buyers. Don’t let anyone pressure you. Take some time, explore your options and make the simplest decision for you and your family.

STEP #3: Consider and Accept Offers

Evaluate your offer, compare it with others and receive the simplest. If you’ve got a structured settlement, it’s important to know that you simply are going to be selling your payment rights at a reduction to whichever company you select. The lower the discount rate, the more you, the vendor, will benefit because your payments will retain a greater cash value. The upper the discount rate, the more buyers will benefit.

Discount rates are negotiable. But most buyers have rates they typically stick with once they offer you a quote. The typical discount rate ranges between 9 and 18 percent. It is consistent to the National Settlement Buyers Association.

STEP #4: Complete the Document

The buyer and your insurance firm will process the paperwork for the sale of a billboard annuity. Once you’ve got completed the documentation for transferring ownership and designation of a payee to the customer. Subsequent process takes about four weeks.

To sell annuity payment requires information and complete various forms. You’ll also got to send a replica of your original structured settlement contract to the factoring company. If you lose your original contract, contact the insurance firm that issued your check and invite a replica of your policy. Alternatively, you’ll contact the attorney who negotiated your settlement.

Documents You Will Need to Sell Annuity Payment:

- Two sorts of identification

- Completed application

- Copy of the first structured settlement contract

- Release agreement

Once you receive your cash offer, the factoring company will send you a transfer document to sign and notarize. The earlier you come back these documents, the earlier you’ll receive your money. Always keep records of all transactions during a secure and simply accessible location.

STEP #5: Get Approved and Receive Your Money

The insurance firm that issues the annuity contract must approve the sale of the commercial annuity. As long because the sale is legal and therefore the buyer is in good standing, the insurance firm will approve your sale. And you will get your money as fast because the law allows.

It takes between 45 and 90 days on the average to sell annuity payment. Some states require sellers to receive knowledgeable appraisal of a purchase by a 3rd party. While others allow a cool down period during which you’ll change your mind about the sale. Before finalizing sell annuity payment, test together with your attorney or financial advisor about the unique laws in your state.