How many times do you check your bank account? If you manage a business including its financial transactions, you surely need the regular information about your bank account. It is important to check the recent transaction and ensure any transaction that you did not recognize. For your information, every bank has a responsibility to prepare the document of each customer about their bank transaction for the past month. Meanwhile, you are pleased to request it for your personal purposes. This day, we are going to discuss about Bank Statement. It includes Bank Statement Format, the purposes as well as the steps how to get a Bank Statement. Enjoy reading!

What is Bank Statement?

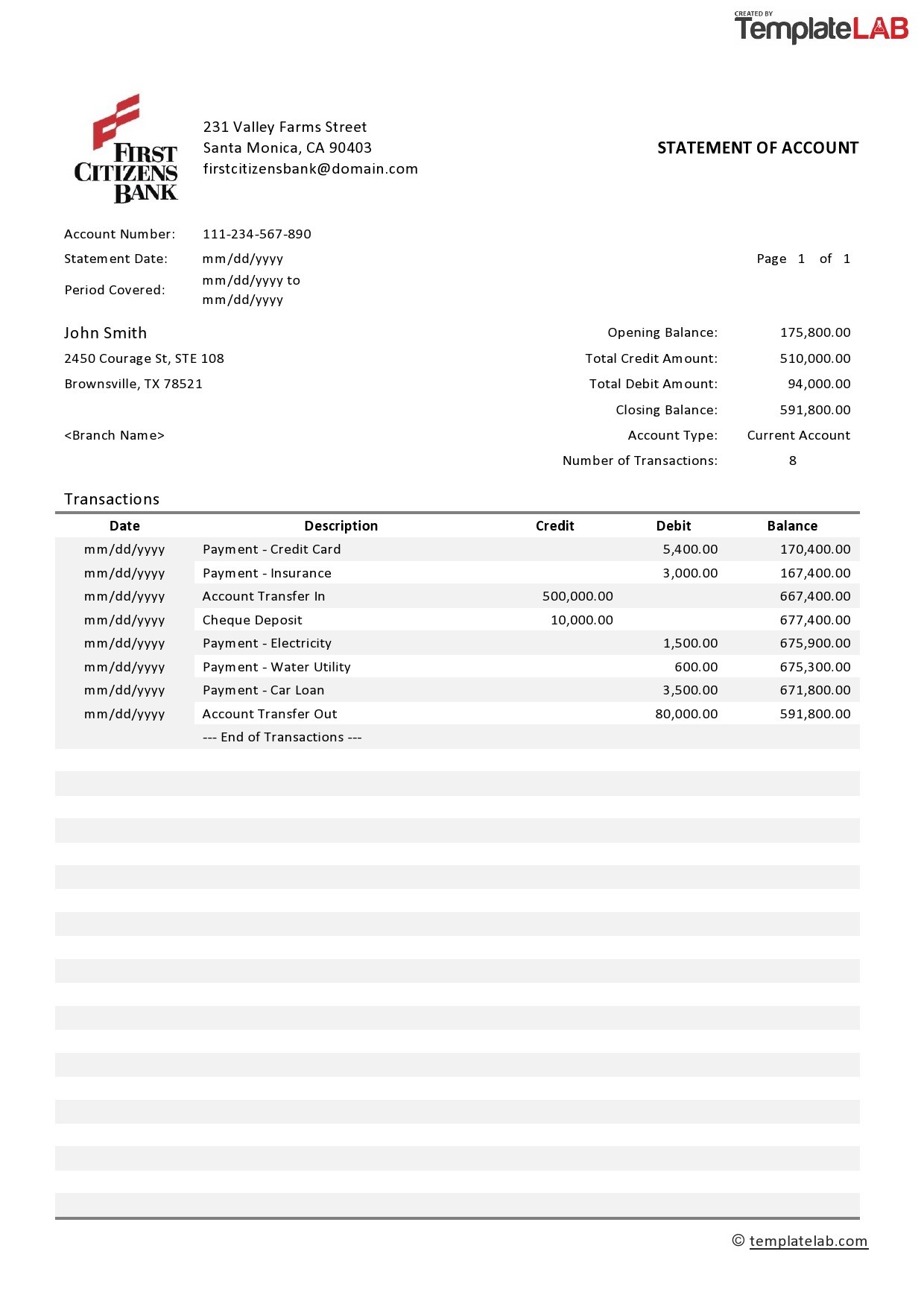

Bank Statement is a legal summary of the financial transaction arising within certain period of time for each bank account which is held by a business or a person with a financial institution. This statement is a legal document which is prepared by the financial institution regularly in certain period of time, usually within a month. It contains the relevant information for the account including the total amount of the payable by the certain time, the recent bank account balance as well as the transaction’s history.

Practically, the customers of the bank account are pleased to request the statement every month. Sometimes, the start date of the statement is the day after the last day of the previous statement period. Yet, for some cases, the customers can request the statement or the back account’s history for some period of time. Once the statement delivered to the account’s holders, the document is irreversible. Even you find some errors, you are able to correct it on the next following statement through attaching the reason for the adjustment.

What is Bank Statement Format?

Alright, you may need to know the format of Bank Statement in order to ensure whether you don’t miss any single information on it. Basically, there are two main parts of Bank Statement Format and here they are:

-

The Account Summary

First of all, the account summary is available at the top of the first page of the bank statement. It is the opening which conclude the balance, deposit, added interest, credits, fees as well as back charges. It will end with the closing balance.

-

Transaction Details

Second of all, the transaction details show all about the bank transaction in a chronological order. Sure, it includes all data from the first day to the last period of the statement. The details record the information about date, amount, name of the payer, location of transaction and many more. Generally, here all list of Bank Statement Format:

- Account Number

- Name and Address of the bank’s holder

- Statement Period

- Bank’s Holder Service Number

- Link to reports the fraudulent activity

- Beginning balance for the time period

- Deposit, it includes:

- Checks

- Direct Deposit

- Electronic Transfers

- Cancelled payment

- Credits

- Withdrawals, it includes:

- Payment

- Electronic Transfer

- ATM withdrawals

- Auto Payment

- Fees Charges (bank’s policy)

- Dividends Earned

- The last balance for certain time of period

How to Get a Bank Statement?

In some cases, most banks will provide the bank statement every month. But, some others may prepare it twice a year. But again, the customers or card holders are pleased to request the bank statement anytime they need the information about their recent transaction’s history. There are some ways you can do to get the statement and here they are:

-

Step 1# Via Online

First of all, you can get your bank statement through online. You can go to bank’s official website and log in to your account. As always, you need to submit the username and password. If you don’t have it yet, you can click at “Create Account” button and follow the registration steps. Just in case you face troubles, you should not hesitate to call the customer services and get the help.

Once you access your account, you need to find out the Electronic Statement Menu. Somehow, it is available at the menu “Services”, “Bank Statement” or “e-Statement”. Then, you can select the statement period you want to get. You are able to download it or directly print it out.

The benefit of accessing the electronic Bank Statement is about to access the paperless statement. You can go to “Go Paperless” menu and follow the instruction. Through this feature, you will receive the regular statement online. Instead of coming to the bank or even get it via mail, this paperless statement services will give you the opportunity to earn some points or reward. Based on the bank institution, you may get the one-time bonus credit or other offers.

-

Step 2# Via Mobile App

Second of all, you are able to access your electronic Bank Payment through your mobile application. Like all we know, most banks prepare the mobile banking services to ease the transaction. You can use this app to check your monthly statement instead of coming to the bank.

In line with the online access, you only need to open your mobile application and log in to your account, Please be sure that you have owned the account. For the sake of security, it is better to register the account at the bank and ask the customer service to activate it. Once you have registered it, you can log in by submitting the user id and password.

Then, you can go to “Bank Statement” or “e-Statement” and select the period of statements you need to get. Within less than a minute, you will receive the detail of statement. Sure, you are free to download it, keep it on your secure place or even print it out as your personal document.

-

Step 3# Via Mail

Third of all, you are able to get the statement offline or via mail. It is conventional way that most of the bank’s users will do. Once you are registered on a bank institution, the bank will automatically send you the regular statement via mail, It means that you will receive a paper consist of your bank transaction details. It may seem convenience so you can change it to the paperless statement services. You can call the customer service, come to the bank or even access the bank official website.

Parts of Bank Statement

- Opening/Header

- Content

- Closing

We hope that it can be useful for you. Thanks for reading and see you soon!